How Does the Balanced Scorecard Help Banks Track Key Performance Indicators (KPIs)?

1. Measuring Financial Performance

Banks use the Balanced Scorecard to monitor key financial KPIs such as revenue growth, return on assets, and cost-to-income ratio. Tracking these indicators helps ensure profitability and financial stability.

2. Enhancing Customer Satisfaction

Customer-related KPIs, such as customer retention, satisfaction scores, and service response time, are crucial for banks. The Balanced Scorecard helps track these metrics, ensuring a focus on improving customer experience.

3. Monitoring Internal Processes

Operational efficiency is vital in banking. KPIs such as loan processing time, transaction accuracy, and compliance adherence are tracked to enhance internal processes and reduce risks.

4. Supporting Employee Performance

Employee productivity and engagement impact banking operations. The Balanced Scorecard helps track performance-related KPIs like training completion, employee turnover, and service quality to improve workforce effectiveness.

5. Ensuring Risk Management and Compliance

Regulatory compliance is a key focus for banks. The Balanced Scorecard allows tracking of KPIs related to fraud detection, risk exposure, and regulatory adherence, ensuring compliance with industry standards.

6. Driving Strategic Growth

By aligning KPIs with long-term goals, banks can track progress in expanding their market reach, launching new services, and improving digital banking capabilities to stay competitive.

7. Improving Decision-Making

Real-time tracking of KPIs through the Balanced Scorecard enables banks to make data-driven decisions, improving overall performance and customer trust.

What Are the Most Important KPIs for Banks Using a Balanced Scorecard?

1. Financial Performance KPIs

Banks track key financial indicators to measure profitability and stability. Important KPIs include net interest margin, return on assets, cost-to-income ratio, and revenue growth. These metrics help assess financial health and operational efficiency.

2. Customer Satisfaction KPIs

Customer experience is crucial for banks. Metrics such as customer retention rate, satisfaction scores, net promoter score (NPS), and complaint resolution time help measure service quality and customer loyalty.

3. Operational Efficiency KPIs

Effective internal processes improve banking operations. Important KPIs include loan processing time, transaction accuracy, ATM uptime, and service wait times. These indicators ensure smooth and efficient banking services.

4. Risk Management and Compliance KPIs

Regulatory compliance is critical in banking. Banks monitor fraud detection rates, non-performing loan ratios, capital adequacy ratios, and audit compliance scores to manage risks and meet legal requirements.

5. Employee Performance KPIs

A strong workforce contributes to banking success. Key employee-related KPIs include training completion rate, employee turnover rate, productivity levels, and performance appraisals. These metrics ensure a skilled and engaged workforce.

6. Digital Banking KPIs

With increasing digitalisation, banks measure mobile app usage, online transaction success rate, cybersecurity incidents, and digital adoption rates. These KPIs help improve digital banking services and security.

7. Growth and Market Expansion KPIs

To stay competitive, banks track new customer acquisition, market share, and branch expansion. These indicators help measure strategic growth and market positioning.

How Does the Balanced Scorecard Align Financial and Non-Financial Banking KPIs?

1. Integrating Financial and Non-Financial Metrics

The Balanced Scorecard helps banks align financial and non-financial KPIs by linking profitability and operational efficiency with customer satisfaction, risk management, and employee performance. This ensures a balanced approach to strategic growth.

2. Financial Performance as a Core Measure

Banks use financial KPIs like net interest margin, return on equity, and cost-to-income ratio to track profitability. These indicators provide insights into revenue generation and cost control while being influenced by non-financial factors.

3. Customer Satisfaction and Service Quality

Metrics such as customer retention rate, net promoter score (NPS), and complaint resolution time help banks measure service quality. A positive customer experience directly impacts financial growth by increasing deposits, loans, and transaction volumes.

4. Operational Efficiency and Risk Management

Efficient internal processes reduce costs and improve service delivery. KPIs such as loan processing time, fraud detection rates, and regulatory compliance scores help banks enhance security and operational reliability, leading to better financial stability.

5. Employee Performance and Productivity

Employee-related KPIs, including training completion rates, productivity levels, and turnover rates, contribute to overall banking success. A skilled and motivated workforce ensures better customer service and improved financial results.

6. Digital Transformation and Technological Integration

With increasing digitalisation, banks track online transaction success rates, cybersecurity incidents, and mobile banking adoption. These non-financial KPIs influence revenue growth and customer retention in the digital banking sector.

7. Creating a Balanced Strategic Approach

By linking financial performance with customer satisfaction, operational excellence, and employee engagement, the Balanced Scorecard ensures a holistic strategy. This alignment helps banks achieve long-term growth and stability.

How Can Banks Use a Balanced Scorecard to Improve Customer Satisfaction?

1. Aligning Customer Goals with Business Strategy

The Balanced Scorecard helps banks connect customer satisfaction with overall business objectives. By integrating customer-related KPIs into strategic planning, banks can enhance service quality and loyalty.

2. Measuring Customer Satisfaction Metrics

Banks use key indicators like customer retention rate, net promoter score (NPS), and feedback ratings to assess satisfaction levels. Tracking these metrics allows continuous improvements in customer service.

3. Enhancing Service Quality and Responsiveness

Reducing response times for inquiries, processing transactions efficiently, and resolving complaints quickly are essential for customer satisfaction. The Balanced Scorecard ensures these operational goals align with customer expectations.

4. Improving Digital Banking Experience

With the rise of online banking, tracking mobile app performance, uptime, and user engagement helps banks provide seamless digital experiences. A well-functioning digital platform enhances customer convenience and trust.

5. Strengthening Customer Relationships

By monitoring personalised service efforts, such as tailored financial products and proactive support, banks can foster long-term relationships. Customer engagement KPIs help in evaluating relationship-building initiatives.

6. Enhancing Employee Training and Support

Well-trained employees provide better customer service. Monitoring training completion rates and service quality scores ensures that staff are equipped to meet customer needs efficiently.

7. Continuous Improvement Through Feedback

The Balanced Scorecard supports a structured approach to collecting and acting on customer feedback. Regular surveys and sentiment analysis help banks refine their services for a better overall experience.

How Does a Balanced Scorecard Enhance Risk Management in Banking?

1. Integrating Risk Management with Strategy

The Balanced Scorecard helps banks align risk management with overall strategic goals. By incorporating risk-related key performance indicators (KPIs), banks can proactively identify and mitigate potential threats.

2. Monitoring Financial Risks

Tracking financial stability metrics such as liquidity ratios, credit risk exposure, and capital adequacy ensures that banks maintain a strong financial position. These indicators help prevent financial crises and ensure regulatory compliance.

3. Strengthening Operational Risk Controls

Operational risks, such as system failures, fraud, and process inefficiencies, can impact a bank’s performance. The Balanced Scorecard enables continuous monitoring of internal processes, reducing operational vulnerabilities.

4. Enhancing Compliance and Regulatory Adherence

Regulatory compliance is critical for banks. The Balanced Scorecard incorporates compliance KPIs, helping banks track adherence to industry regulations and reduce legal risks.

5. Improving Credit Risk Management

By evaluating loan default rates, customer creditworthiness, and debt recovery performance, banks can manage credit risk effectively. The Balanced Scorecard provides a structured framework for monitoring lending activities.

6. Strengthening Cybersecurity Measures

With increasing digital transactions, banks face cybersecurity threats. Monitoring system vulnerabilities, data breaches, and response times ensures that cybersecurity risks are minimised.

7. Supporting Decision-Making with Data

The Balanced Scorecard provides real-time insights into risk factors, enabling banks to make informed decisions. Data-driven risk management leads to greater stability and long-term success.

What Role Does AI Play in KPI Tracking Within a Bank’s Balanced Scorecard?

1. Automating Data Collection

AI simplifies KPI tracking by automating data collection from multiple banking systems. This reduces manual errors and ensures that performance metrics are always updated in real time.

2. Enhancing Data Accuracy

AI-driven analytics improve data accuracy by detecting inconsistencies and anomalies. This ensures that key performance indicators (KPIs) provide a reliable representation of a bank’s performance.

3. Predicting Financial Trends

AI uses predictive analytics to identify trends in financial data. Banks can use these insights to anticipate risks, forecast revenue, and improve decision-making for long-term success.

4. Improving Risk Management

AI-powered tools monitor risk-related KPIs, such as fraud detection and credit risk assessment. Automated alerts help banks take proactive measures to minimise financial losses.

5. Enhancing Customer Experience Metrics

AI analyses customer interactions to measure satisfaction levels. Banks can track service response times, customer feedback, and transaction patterns to improve customer experience.

6. Streamlining Performance Reporting

With AI, banks can generate automated reports with visual insights. This makes it easier to track KPIs across different departments and align them with strategic goals.

7. Supporting Real-Time Decision-Making

AI enables real-time tracking of banking KPIs, allowing management to respond quickly to performance fluctuations. This leads to better operational efficiency and strategic growth.

How Does the Balanced Scorecard Support Regulatory Compliance in Banking?

1. Aligning Compliance with Strategic Goals

The Balanced Scorecard helps banks integrate regulatory compliance into their overall strategy. By tracking compliance-related key performance indicators (KPIs), banks can ensure that legal and industry standards are met.

2. Monitoring Risk Management

Regulatory compliance requires strict risk management. The Balanced Scorecard provides a structured way to track financial risks, operational risks, and cybersecurity threats, helping banks stay compliant with regulations.

3. Enhancing Transparency and Accountability

Banks must demonstrate compliance with financial regulations. The Balanced Scorecard improves transparency by clearly defining roles, responsibilities, and performance expectations for compliance-related tasks.

4. Improving Reporting Accuracy

Regulatory bodies require accurate and timely reporting. The Balanced Scorecard supports data-driven decision-making by providing real-time insights into compliance metrics, reducing reporting errors.

5. Strengthening Internal Audits

By tracking compliance KPIs, banks can identify gaps in policies and procedures. This ensures that internal audits are effective, helping institutions meet regulatory requirements and avoid penalties.

6. Supporting Ethical Banking Practices

The Balanced Scorecard promotes a culture of compliance by measuring adherence to ethical standards. This reduces risks associated with fraud, money laundering, and other regulatory violations.

7. Adapting to Regulatory Changes

Financial regulations evolve over time. The Balanced Scorecard provides a flexible framework that allows banks to adjust compliance strategies and stay ahead of regulatory updates.

How Can a Bank Improve Operational Efficiency Using a Balanced Scorecard?

1. Streamlining Internal Processes

The Balanced Scorecard helps banks identify inefficiencies in daily operations by tracking key performance indicators (KPIs) related to transaction speed, customer service, and processing times. This allows for continuous process improvement.

2. Enhancing Employee Performance

By aligning staff goals with strategic objectives, banks can use the Balanced Scorecard to measure employee productivity and effectiveness. Training programs and performance incentives can be developed based on these insights.

3. Reducing Operational Costs

Monitoring financial KPIs through the Balanced Scorecard helps banks identify areas where costs can be reduced, such as optimising resource allocation, minimising waste, and improving procurement processes.

4. Improving Customer Service

Operational efficiency is directly linked to customer satisfaction. The Balanced Scorecard helps banks measure service quality, wait times, and customer feedback, ensuring a seamless banking experience.

5. Automating Routine Tasks

Using the Balanced Scorecard, banks can track the effectiveness of automation tools, such as digital banking solutions and AI-driven customer support, to enhance efficiency and reduce manual workload.

6. Strengthening Risk Management

By integrating risk-related KPIs, banks can use the Balanced Scorecard to detect potential issues early, ensuring compliance with financial regulations and reducing operational risks.

7. Enhancing Decision-Making

Real-time data from the Balanced Scorecard allows bank leaders to make informed decisions based on performance trends, leading to smarter resource allocation and improved efficiency.

What Are the Four Perspectives of a Balanced Scorecard in Banking?

1. Financial Perspective

The financial perspective focuses on profitability, cost efficiency, and revenue growth. Banks track key performance indicators (KPIs) such as return on assets, net interest margin, and cost-to-income ratio. These metrics help measure financial stability and ensure long-term success.

2. Customer Perspective

This perspective assesses how well a bank meets customer expectations. It includes KPIs like customer satisfaction, retention rates, and service quality. A strong focus on customer experience helps banks build trust, increase loyalty, and attract new clients.

3. Internal Process Perspective

The internal process perspective ensures operational efficiency and smooth banking transactions. It covers metrics such as loan processing time, transaction accuracy, and fraud detection. Improving internal processes enhances service delivery and reduces operational risks.

4. Learning and Growth Perspective

This perspective focuses on employee development, innovation, and technology adoption. Banks measure staff training, digital banking advancements, and employee engagement. Investing in learning and innovation helps banks stay competitive and adapt to changing financial environments.

By balancing these four perspectives, banks can create a structured strategy that enhances performance, meets customer needs, and ensures long-term financial stability.

How Does the Balanced Scorecard Help Banks Optimise Resource Allocation?

1. Aligning Financial Resources with Strategic Goals

The Balanced Scorecard helps banks distribute financial resources effectively by linking budgets to strategic objectives. By tracking key financial metrics such as return on investment and cost efficiency, banks can allocate funds to the most profitable areas while reducing unnecessary expenses.

2. Enhancing Customer-Focused Investments

Banks can use the Balanced Scorecard to prioritise investments that improve customer satisfaction. By analysing metrics such as customer retention rates and service quality, banks can allocate resources to customer service improvements, digital banking, and personalised financial products.

3. Improving Operational Efficiency

The Balanced Scorecard helps banks identify areas where resources are underutilised or wasted. By monitoring process efficiency indicators like loan approval times and transaction processing speed, banks can streamline operations, reduce costs, and enhance productivity.

4. Strengthening Workforce Development

Human resources are critical to banking success. The Balanced Scorecard tracks employee performance, training, and engagement levels, ensuring resources are allocated to workforce development. Investing in employee skills enhances productivity and service quality.

By using the Balanced Scorecard, banks can make data-driven decisions that optimise resource allocation, ensuring financial stability, customer satisfaction, and operational excellence.

How Can Banks Integrate Real-Time Data into Balanced Scorecard KPI Tracking?

1. Implementing Automated Data Collection

Banks can integrate real-time data into their Balanced Scorecard by using automated data collection systems. These systems pull information from transactions, customer interactions, and operational activities, ensuring up-to-date performance tracking.

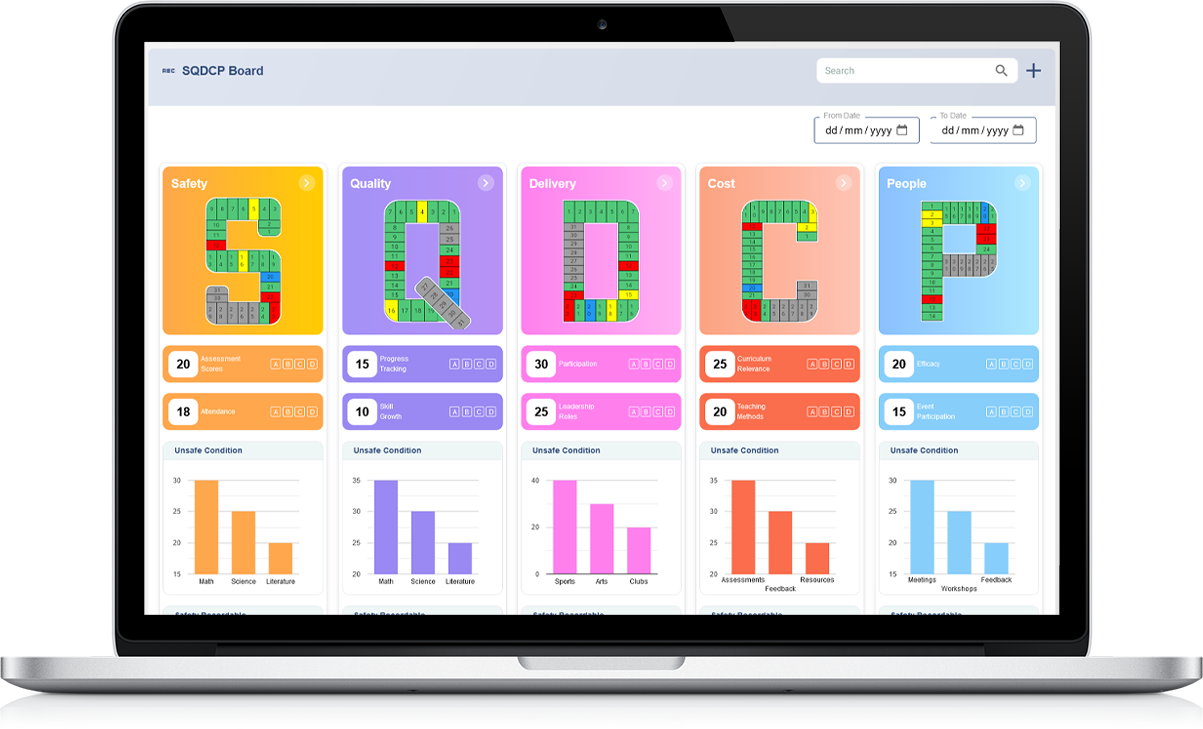

2. Using Advanced Analytics and Dashboards

Real-time dashboards provide instant visibility into key performance indicators (KPIs). Banks can analyse data trends, detect issues early, and make informed decisions to improve financial performance, customer service, and risk management.

3. Enhancing Customer Insights

Real-time data allows banks to track customer behaviour, transaction patterns, and service feedback instantly. This helps in adjusting strategies to improve customer satisfaction and retention, aligning with the customer-focused perspective of the Balanced Scorecard.

4. Strengthening Risk and Compliance Monitoring

Monitoring risk indicators in real time helps banks detect fraudulent activities, credit risks, and regulatory compliance breaches. This proactive approach ensures the organisation remains compliant while minimising financial risks.

5. Improving Decision-Making Efficiency

With real-time data integration, banks can respond faster to market changes, operational challenges, and customer needs. This ensures that resources are allocated effectively and strategic goals are met without delays.

By leveraging real-time data, banks can enhance the accuracy and effectiveness of their Balanced Scorecard KPI tracking, leading to better performance and strategic success.

What Are the Benefits of Using a Digital Balanced Scorecard for Banking KPIs?

1. Real-Time Performance Tracking

A digital Balanced Scorecard allows banks to monitor key performance indicators (KPIs) in real time. This ensures that financial, customer, internal process, and growth metrics are always up to date, helping leaders make informed decisions quickly.

2. Improved Data Accuracy

Manual reporting can lead to errors and outdated information. A digital system integrates data from multiple sources, reducing inconsistencies and ensuring accurate performance measurement.

3. Enhanced Decision-Making

By providing instant insights into banking operations, a digital Balanced Scorecard helps management identify trends, risks, and opportunities. This enables proactive decision-making and better strategic alignment.

4. Increased Efficiency

Automated KPI tracking eliminates the need for manual data collection and reporting, saving time and resources. This allows banking professionals to focus on strategic initiatives rather than administrative tasks.

5. Better Regulatory Compliance

Banks must adhere to strict financial regulations. A digital Balanced Scorecard helps track compliance-related KPIs, ensuring that the institution meets regulatory requirements and avoids penalties.

6. Customisable Dashboards

Digital solutions offer interactive dashboards tailored to different banking functions. From risk management to customer experience, teams can access relevant data for their specific roles.

Using a digital Balanced Scorecard improves KPI management in banking, leading to better operational performance, strategic alignment, and customer satisfaction.

How Does the Balanced Scorecard Support Strategic Decision-Making in Banks?

1. Aligning Strategy with Operations

The Balanced Scorecard helps banks align their strategic goals with day-to-day operations. By tracking key performance indicators (KPIs) across financial, customer, internal process, and learning perspectives, banks can ensure that every action supports long-term objectives.

2. Data-Driven Decision-Making

With a structured approach to performance measurement, banks can base their strategic decisions on real data rather than assumptions. This leads to more informed choices about investments, resource allocation, and market positioning.

3. Enhancing Risk Management

Risk management is crucial in banking. The Balanced Scorecard helps track financial stability, regulatory compliance, and operational risks, allowing banks to make proactive adjustments and reduce potential threats.

4. Improving Customer-Centric Strategies

By monitoring customer satisfaction, service quality, and retention rates, banks can develop strategies that enhance customer experience. This supports long-term growth and brand loyalty.

5. Measuring Performance Across Departments

The Balanced Scorecard provides a clear framework for evaluating different banking functions. Whether it is loan management, investment strategies, or customer service, decision-makers can assess performance and drive improvements.

6. Supporting Long-Term Growth

Strategic decisions in banking must balance short-term profitability with long-term sustainability. The Balanced Scorecard helps leaders focus on continuous improvement, innovation, and workforce development to secure future success.

By using the Balanced Scorecard, banks can enhance strategic decision-making, ensuring financial stability, customer satisfaction, and operational excellence.

What Challenges Do Banks Face When Implementing a Balanced Scorecard?

1. Aligning Organisational Goals

One of the biggest challenges in implementing a Balanced Scorecard in banks is ensuring that all departments align their goals with the overall strategy. Different teams may have conflicting priorities, making it difficult to create a unified approach.

2. Defining the Right Key Performance Indicators (KPIs)

Banks operate in a complex environment with multiple financial and non-financial metrics. Identifying the right KPIs that accurately measure success across various perspectives can be challenging.

3. Data Collection and Accuracy

Effective performance tracking requires accurate and timely data. Banks often face difficulties in gathering data from multiple sources, ensuring consistency, and avoiding errors that could impact decision-making.

4. Resistance to Change

Employees and management may resist adopting a new performance measurement system, especially if they are used to traditional reporting methods. Proper training and communication are essential to gain support across all levels.

5. Integrating with Existing Systems

Many banks use legacy systems that may not integrate smoothly with Balanced Scorecard frameworks. Upgrading or customising software to ensure compatibility can be costly and time-consuming.

6. Maintaining Long-Term Commitment

For a Balanced Scorecard to be effective, banks must regularly update KPIs and strategies. However, maintaining long-term commitment and ensuring continuous improvement can be challenging, especially when immediate financial targets take priority.

By addressing these challenges, banks can successfully implement a Balanced Scorecard, leading to better performance tracking, strategic alignment, and long-term success.

How Can a Bank Measure the Success of Balanced Scorecard Implementation?

1. Achievement of Strategic Goals

A key indicator of success is the extent to which the Balanced Scorecard helps the bank achieve its strategic objectives. Measuring progress against predefined goals ensures that the framework is delivering value.

2. Improvement in Key Performance Indicators (KPIs)

The effectiveness of a Balanced Scorecard can be assessed by tracking improvements in financial, customer, internal processes, and learning-related KPIs. Positive trends indicate that the strategy is working.

3. Enhanced Decision-Making

A well-implemented Balanced Scorecard should provide clearer insights, enabling management to make informed decisions. If decision-making processes improve, it signifies successful implementation.

4. Employee Engagement and Alignment

Staff at all levels should understand and support the strategy. Increased employee participation in goal-setting and performance measurement suggests that the Balanced Scorecard is effectively integrated into daily operations.

5. Customer Satisfaction and Retention

A successful Balanced Scorecard should contribute to better customer experiences. Monitoring customer feedback, service quality, and retention rates can indicate how well the bank is performing in this area.

6. Operational Efficiency

Reducing bottlenecks, improving process efficiency, and optimising resource allocation are signs of a well-functioning Balanced Scorecard system. Analysing workflow improvements helps measure success.

7. Regular Review and Adaptation

A successful Balanced Scorecard remains relevant over time. Regular reviews, adjustments to KPIs, and continuous improvements indicate that the system is effectively supporting long-term growth.

By tracking these factors, banks can assess the impact of their Balanced Scorecard and refine it for sustained success.